Transaction Funding leverages the exceptional access, abilities and experience of Swiss Financiers’ team taking companies public and wraps it up in a short-term product with a uniquely attractive risk reward profile.

Transaction Funding provides unfettered access to one of the most consistently lucrative yet complex processes in the investment world: that of taking private companies to list on public markets. Thus, enabling investors to directly participate and gain from the transition in a company’s valuation, from one that is based on material achievement, “what it has already done to date”, to one that is based on prospective achievement, “what it can potentially do in the future”.

The uplift in valuation multiples regularly experienced by companies during this transitional period is transformational and typically has no equal in the rest of most companies’ lifetimes. Yet the opportunity to benefit from it is not easy for most investors to access due to the complexity of the process and the range of skills required to successfully navigate and evaluate the transition. There has also been a lack of transparency maintained by traditional players to intentionally obfuscate the space to deter competition and access.

Swiss Financiers is changing that by providing an innovative solution to a traditional problem. Transaction Funding invites investors to participate in the private to public company revaluation process directly by funding the transaction costs related to that process and thus benefiting firsthand from the transformational revaluation event.

Example of Single Company Transaction Funding

Swiss Financiers concentrates on IPOs of US$ 100 million and above, for which the related transaction expenses typically costs US$5 million for each US$ 100 million raised at IPO. Hence, the expenses for a $300 million IPO would cost approximately $15 million.

For purposes of further demonstration, we have taken a public offering of US$ 200 million in capital, with an expected transaction expense of US$ 10 million. A public listing may take 12-24 months to conclude depending on the precise structure and nature of the listing. As soon as the public funds are released, the investor recoups their initial investment plus a 100% return, so US$20m is returned on an initial outlay of US$10m. Depending on the type of deal structure, investors may also receive bonus points based on SFI’s revenue from same transaction; these sums will vary but can be significant, resulting in a 2.4x or more over 12 just months. For example:

| Capital Raised by Issuer | $200,000,000 |

|---|---|

| SFI Fees | $24,000,000 (12%) |

| SFI Equity Participation | $20,000,000 (10%) |

| Total Value of SFI Revenue (Cash+Equity) | $44,000,000 |

| PPTF Investor Capital | $10,000,000 |

| Repayment of Initial Capital | $10,000,000 |

| Return from Public Offering | $10,000,000 (100%) |

| Return from % of SFI Revenue | $4,400,000 (10%) |

| PPTP Total ROI | $14,400,000 (144%) 2.44 |

Risk Mitigation

So long as the issuing company successfully launches its public offering, then the bulk of the returns are paid directly from the funds raised, the details of which will be included in the public offering documents, hence contractually ensured. One of SFI Founding Partner’s, Marc Deschenaux, has successfully completed 180 public offerings out of 201 attempted, a success rate of 90%. That success rate of has been maintained by a combination of careful selection of suitable companies, and the experience and abilities of the team to identify and avoid complications early in the process before funds are even committed. Even the 21 cases in which a public offering was not completed, typically due to internal conflicts, the companies did conclude other business that provided fee generating income. Hence, SFI can provide significant risk mitigation through its experience in selection, analysis, process and, as a last resort, alternative closing options. The key element that ensures SFI’s constant attention to such risk mitigation is its own equity participation in each deal. SFI’s economic interests are directly aligned with the issuer and hence with the Transaction Funding investors also.

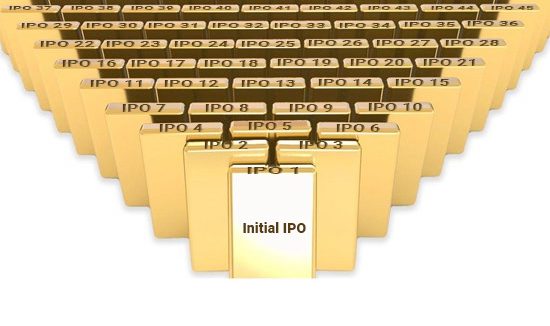

This example only takes into consideration the return to the investor of funding the expenses for a single IPO. The benefits of funding a Cascade Program (described below) which triggers the funding for a series of IPOs, may result in greater returns and lower risk as a result of increased volume and greater diversity.