This presentation focuses on a unique structure designed to assist and support private companies achieve public listing, while simultaneously creating a forward looking partnership with those companies to support successive waves of entrepreneurial public listings, through a process and platform called the IPO Cascade.

The IPO Cascade is a patented process conceived by Marc Deschenaux and licensed exclusively to Swiss Financiers Inc.

Swiss Financiers Inc, or SFI, is a Delaware registered company with a Geneva office that specializes in forging creative financial partnerships with private companies that seek public funding.

The team at SFI has significant experience in dealmaking and structuring, having successfully completed almost 200 IPOs.

The IPO Cascade is just one of the innovations that Swiss Financiers has created to serve founding entrepreneurs.

SFI helps private companies prepare for, and assists their transition to, public market listing through the IPO process.

The team is intimately knowledgeable about the process of revaluation attainable through taking a company public, as well as the individual steps required in that process to achieve a successful IPO.

The principle behind the cascade is to democratize public fundraising

Access to public markets has traditionally been by appointment only, typically involving multiple rounds of expensive pre-IPO funding and dilution so that a lot of the founder’s control and value are given up by the time they reach IPO, if they get there at all.

Swiss Financiers approach is to directly align its interests with the issuer to keep that value and control in the hands of the founding entrepreneurs.

The IPO Cascade is a natural evolution of that concept that not only enables founders to source funding but enlists their help and expertise in funding other founding entrepreneurs.

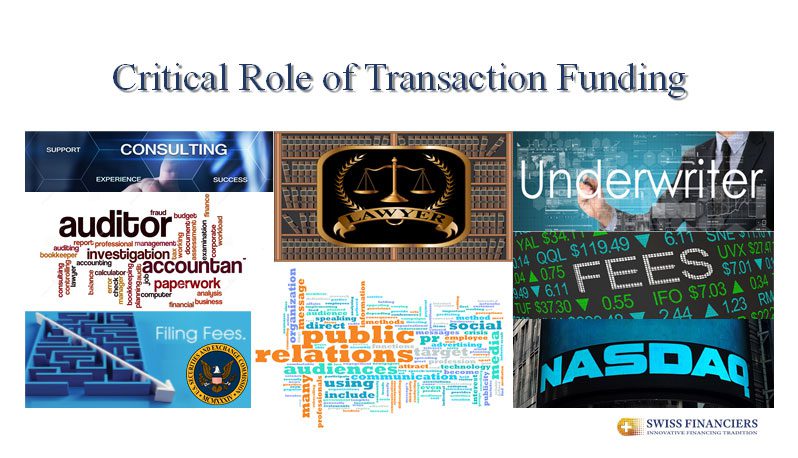

The expense of launching an IPO are considerable because they cover a wide range of essential costs, ranging from accounting, legal, pr and consulting to filing and exchange fees and underwriting costs but having a central dealmaker involved in representing the interests of the issuer can help control and even substantially reduce these costs overall.

All of these expenses collectively come under the title of Transaction Funding and a lot of these expenses need to be met prior to the IPO taking place.

This is where SFI’s unique IPO Incubator Cascade comes in….

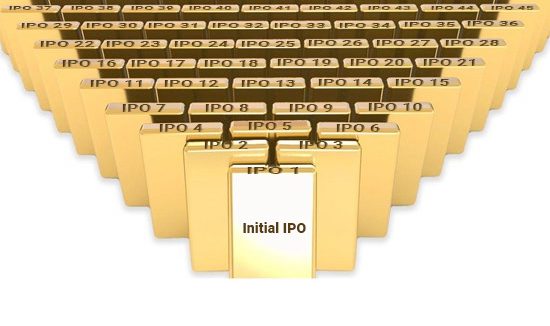

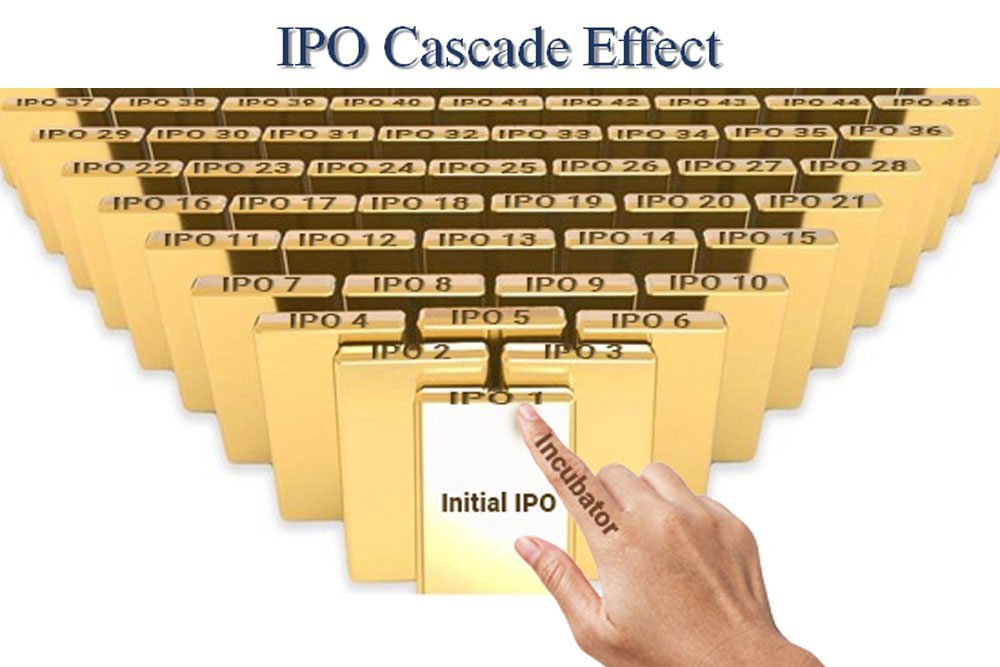

A cascade is a sequence of events in which each event produces the circumstances necessary for the initiation of the next event to occur.

The IPO Cascade ensures that each successful IPO contractually delivers the financing costs necessary for the initiation of the next two or more IPOs to occur.

This patented structure enables the continuation of transaction funding for private companies that might not fit the traditional route to IPO or perceives it as too expensive in both control and cost.

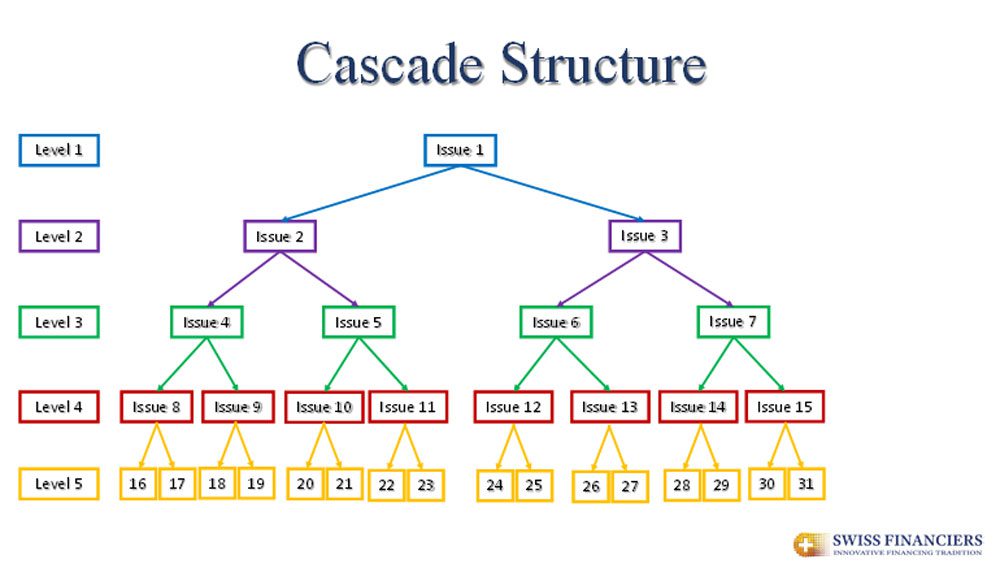

The structure is simple:

A suitable root company is identified to lead the Cascade and as each successful IPO is concluded as part of its capital raising function, documented in each Placement Memorandum, a part of its proceeds goes to funding the next level of the Cascade, ensuring a perpetual flow of transaction funding for successive generations of issuing companies.

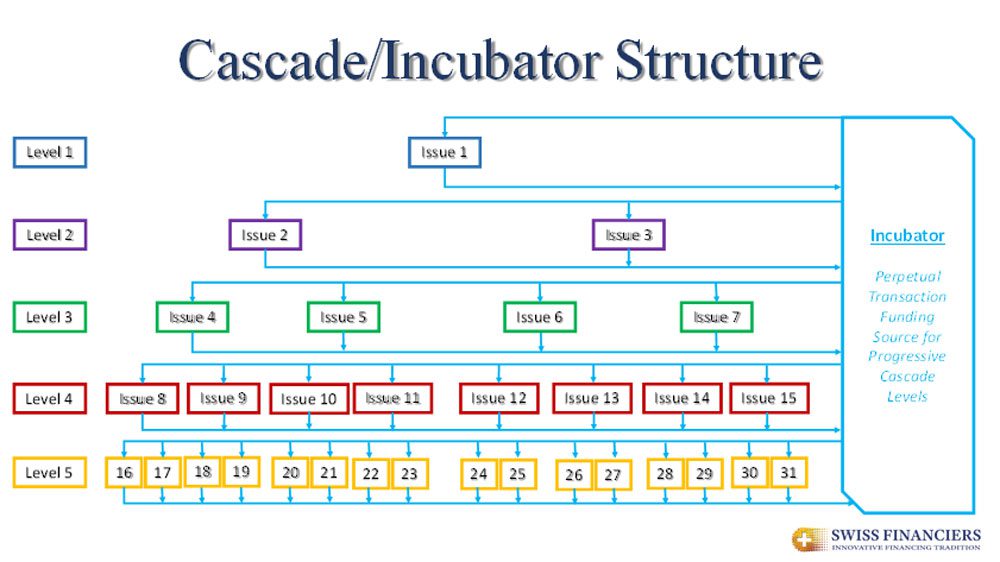

This image of a waterfall type structure succinctly exhibits the effect of the Cascade but does not fully reflect the actual process, because in reality the funds do not flow directly from issuer to issuer but are passed through an Incubator that is able to smooth the flow and maximize the effectiveness of the Cascade.

Having removed the direct links between the progressive Cascade levels, the same shape and pattern remains. It is merely the flow of funds that is slightly different.

A suitable root company is identified to lead the Cascade and the IPO Incubator provides the transaction funding to meet that company’s IPO expenses. In return, the Incubator will receive private shares in each issuing company before its IPO.

Upon each successful IPO, the Incubator will be free to sell its shares that were awarded by the issuing company. The proceeds of these equity disposals will generate a steady profit forf the Incubator, building its coffers and providing the means to fund more issuing companies to IPO.

The returns to the Incubator for funding these transactions will be insured by the issuance of a put option on the shares awarded to the Incubator, thus providing a floor disposal price for the warded shares post IPO. The Incubator may alternatively choose to void the put option by selling their shares in the market, providing equity upside exposure.

The companies chosen to IPO at each level or round will enter into a similar contract. Receiving transaction funding for their IPO and awarding equity and a put option in return each time.

This process enables companies to go public that might not have been considered suitable candidates by the traditional VC, PE and investment banking routes.

Plus, it provides a compelling investment opportunity in the Incubator itself that will experience steady compounded growth that is embedded in the documentation of each subsequent IPO funding round.

The Incubator is the financial engine of the IPO Cascade, providing transactions funding for each successive level of issuing companies to fund the expenses of their IPOs.

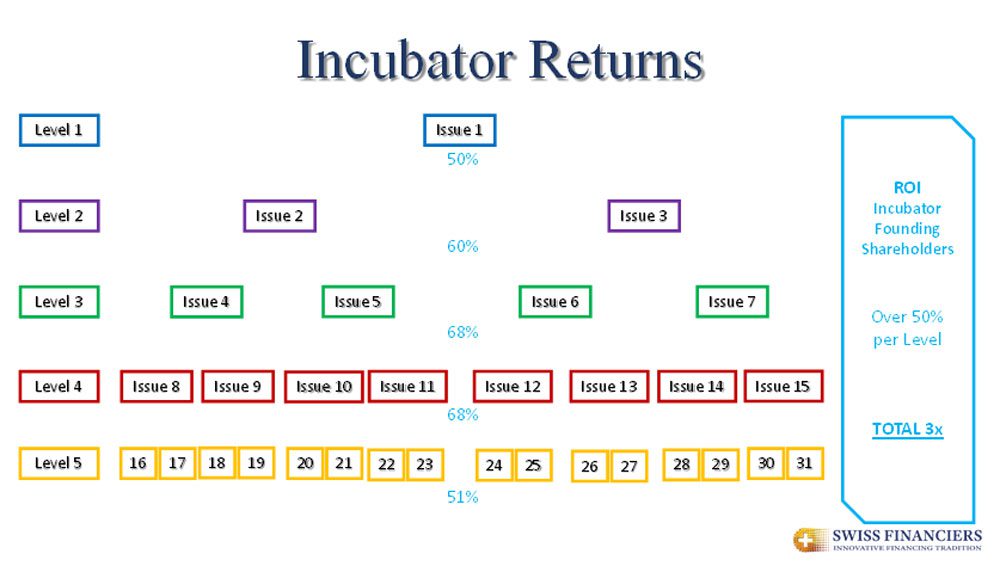

Each successful issue delivers a 2x return to the Incubator. So, the growth of funds in the Incubator is very rapid enabling it to double the number new issuing companies at each level of the Cascade.

A distributed dividend of 25% of gross revenue will be paid out to the shareholders of the Incubator after each successful IPO is completed following the disposal, by put or sale, of the Incubator’s respective equity awards.

The founding Incubator shareholders, those that provided the initial funding for the Incubator, will receive a participation in that distributed dividend starting at 100% for the Level One IPO and declining by 20% for each subsequent Level of IPOs completed.

Hence, for an initial investment of USD10m to fund the root company of the Cascade, the founding Incubator shareholders would receive USD29.5m in distributed dividends upon completion of Level 5, almost a 3x return.

The IPO Cascade is just one of the innovations that Swiss Financiers has created to serve founding entrepreneurs. To discover more about other techniques or about Swiss Financiers itself, please go to our website:

www.SwissFinanciers.com

or contact one of our partners in New York or Geneva.

Thank you for your kind attention. We look forward to hearing your questions and feedback.