The IPO-Kaskade is a patented process conceived by Marc Deschenaux and licensed exclusively to Market Street Capital Inc.

A Company willing to issue equity stock to finance its operations is in lack of capital to fund its Initial Public Offering (IPO) expenses, including Legal advice, accounting, audit, financial public relations, advertising, media, press, infographics, roadshows, hotels, representation, etc…

To resolve this lack of funds, the Company requests the amount from a Transaction Financier.

The Transaction Financier will not invest in the Company’s activities. As his name indicates, this Financier will only finance the Transaction, in our case, the Company’s IPO. The Transaction Financier will act like a bank in a construction loan, paying directly to the suppliers but not investing in the Company.

In exchange for financing its IPO, the Company commits to using a portion of the capital raised through its IPO proceeds in case of its IPO success to pay either:

- the Transaction Financier

oder - the expenses of two or more other companies IPOs designed by the Transaction Financier.

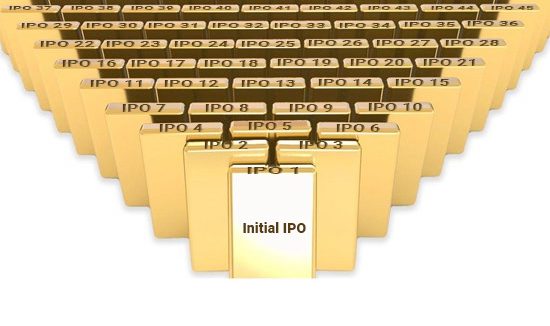

When a Transaction Financier finances several IPOs consecutively, it is referred to as IPO Incubator.

There are two different ways to operate an IPO Cascade:

- either directly where the Company whose IPO was financed is contractually obliged to finance two or more IPOs of companies in the same situation of lack of capital as the Company was before its IPO. These companies are designed by the IPO Incubator,

- or indirectly through the IPO Incubator that surveys the execution and acts like a bank in a construction loan, paying the suppliers directly but not investing directly in the issuer. The IPO Incubator will then finance two or more IPOs of companies in the same situation of lack of capital as the Company was before its IPO.

Subsequently, the two or more companies whose IPOs were financed are contractually obliged to finance two or more IPOs of companies in the same situation of lack of capital as they were before their IPOs.

In both cases, this generates a domino effect, enabling the financing of other IPO transactions.

The IPO Cascade is a patented process conceived by Marc Deschenaux and licensed exclusively to Market Street Capital Inc.

The IPO Cascade is a patented process conceived by Marc Deschenaux and licensed exclusively to Swiss Financiers Inc.

A Company willing to issue equity stock to finance its operations is in lack of capital to fund its Initial Public Offering (IPO)expenses, including Legal advice, accounting, audit, financial public relations, advertising, media, press, infographics, roadshows, hotels, representation, etc…

To resolve this lack of funds, the Company requests the amount from a Transaction Financier.

The Transaction Financier will not invest in the Company’s activities. As his name indicates, this Financier will only finance the Transaction, in our case, the Company’s IPO. The Transaction Financier will act like a bank in a construction loan, paying directly to the suppliers but not investing in the Company.

In exchange for financing its IPO, the Company commits to using a portion of the capital raised through its IPO proceeds in case of its IPO success to pay either:

- the Transaction Financier

oder

- the expenses of two or more other companies IPOs designed by the Transaction Financier.

When a Transaction Financier finances several IPOs consecutively, it is referred to as IPO Incubator.

There are two different ways to operate an IPO Cascade:

- either directlywhere the Company whose IPO was financed is contractually obliged to finance two or more IPOs of companies in the same situation of lack of capital as the Company was before its IPO. These companies are designed by the IPO Incubator,

- oder indirectly through the IPO Incubator that surveys the execution and acts like a bank in a construction loan, paying the suppliers directly but not investing directly in the issuer. The IPO Incubator will then finance two or more IPOs of companies in the same situation of lack of capital as the Company was before its IPO.

Subsequently, the two or more companies whose IPOs were financed are contractually obliged to finance two or more IPOs of companies in the same situation of lack of capital as they were before their IPOs.

In both cases, this generates a domino effect, enabling the financing of other IPO transactions.

Swiss Financiers Inc, or SFI, is a Delaware registered company with a Geneva office that specializes in forging creative financial partnerships with private companies that seek public funding.

The team at SFI has significant experience in dealmaking and structuring, having successfully completed almost 200 IPOs.

Die IPO-Kaskade is just one of the innovations that Swiss Financiers has created to serve founding entrepreneurs.