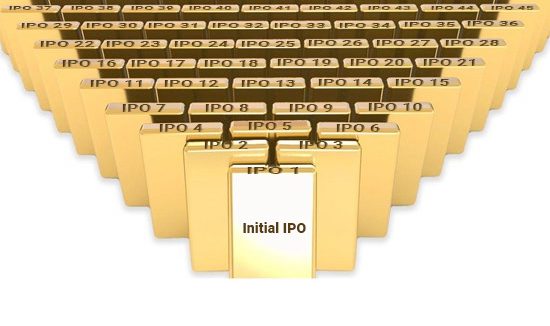

The Cascade IPO structure was created by Marc Deschenaux, co-founder of Swiss Financiers, and is a Patented Business Process offered only by Swiss Financiers. It involves creating, from a single IPO, a stream of funding for additional issues that can continue inexhaustibly in perpetuity.

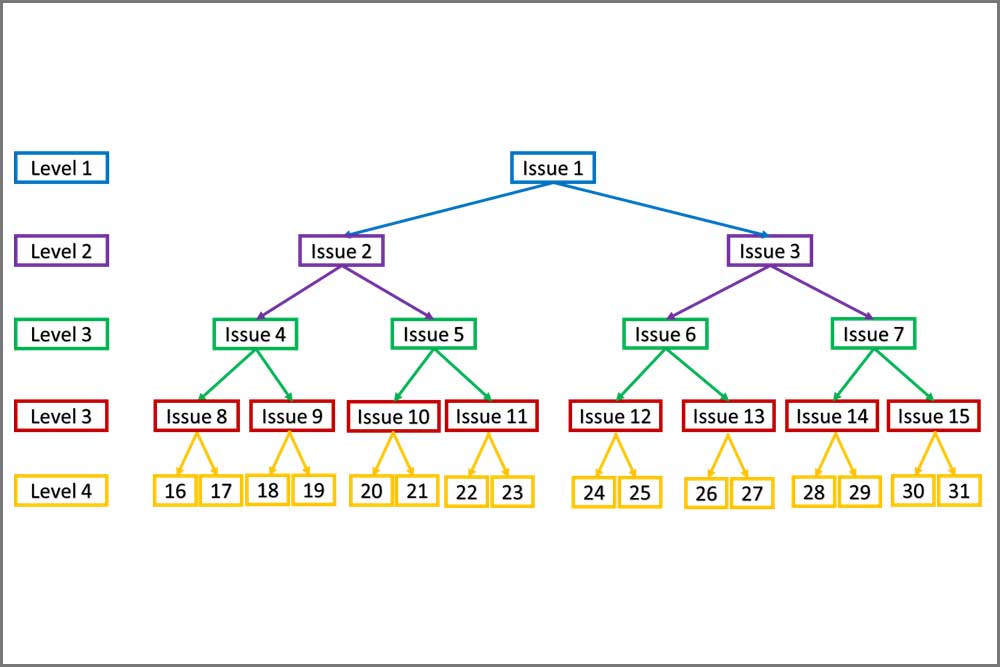

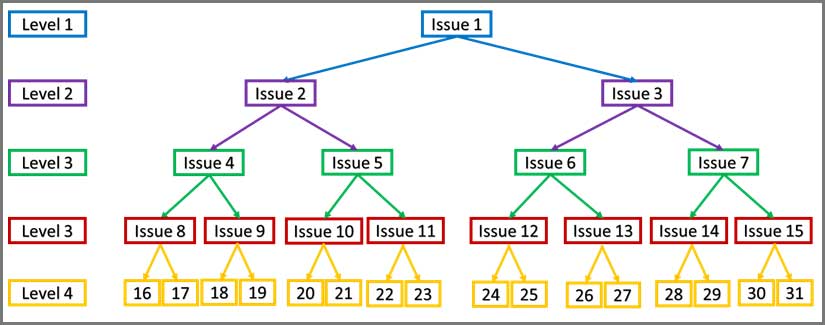

This is achieved by encapsulating in the legal offering documentation of the first and all subsequent issues in the Cascade, a clause that allocates a dedicated portion of the proceeds of the issue to the funding of the expenses for two additional issues. Hence, a $200 million capital raise for the initial company, with transaction expenses of $10m to commence the Cascade, contractually allocates 10% of proceeds to fund the expenses of two additional transactions of $200 million each. In turn each of these public offerings would also in turn allocate 10% of their proceeds to fund two more each. Hence, a waterfall of funding is created to support a growing tree of issuance, the roots of which expand with each level, growing deeper and broader.

Visual Representation of Cascade Structure

The same principals apply for transaction funding of a Cascade structure as for a single IPO. However, there is potential for additional return for the initial transaction funding investor depending on the precise nature and purpose of the Cascade; whether it is an outright investment opportunity or has additional purpose as an issuing vehicle for dedicated use by the original investor. There are a number of adjustments and accommodation that can be made to the program and return structure to benefit differing perspectives and uses that can be discussed and negotiated during the structuring process.